Recession Prolongs, Biotech Firms Lead Market Rise

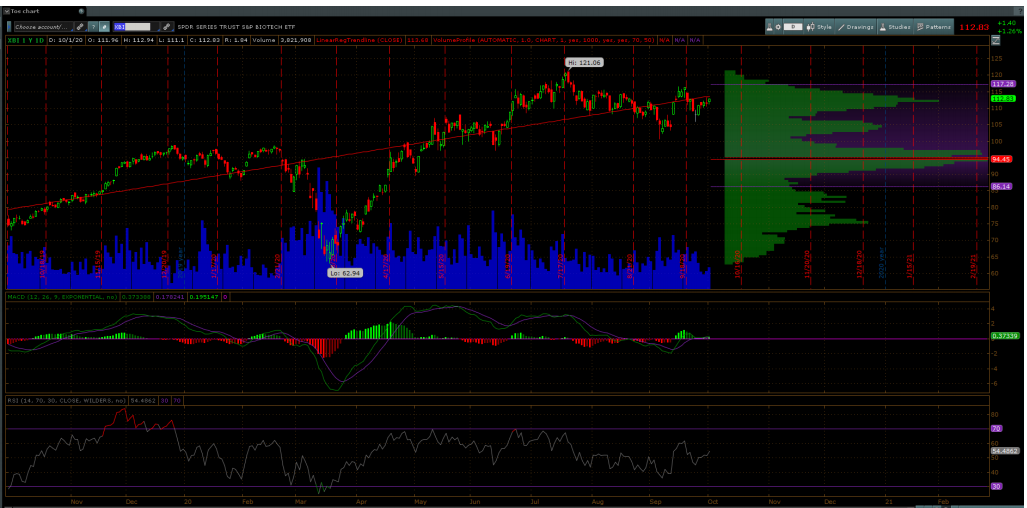

The biotechnology sector of our economy has realized an extended v-shaped recovery that has outperformed the overall stock market. According to the SPDR’s S&P Biotech ETF (XBI), $112.83, the sector realized a 79.3% return from it’s March low as denoted by the chart below.

SPDR SERIES TRUST S&P BIOTECH ETF

The sector has been driven by a handful of stocks with promising pathways to a vaccine for the coronavirus pandemic which has gripped the world since the beginning of February 2020. After reaching a high of $121.06 in July the sector has trading range bound as the timeline for a potential vaccine has become hard to gauge. Additionally, some early clinical setbacks potential risks of fast development have caused investors to move forward cautiously investing in this sector.

Biotech Outlook

Two key events that will take place this month will help paint a picture for the future of the sector in the short-term. First, an upcoming meeting held by the FDA’s Vaccine and Related Biological Products Advisory Committee will meet on October 22nd to discuss the development, authorization and/or licensure of vaccines to prevent the contraction of COVID-19. The second event will be the CDC’s Advisory Committee on Immunization Practices panel meeting which will take place October 28th -30th. This committee meets three times a year to review scientific data and cote on vaccine recommendations.

Investment Implications

Several pharmaceutical companies are in latter-stage developmental trials for a COVID-19 vaccine, with some companies having to halt trials for various reasons. Even though a myriad of reasons has halted trials around the globe, we believe that medical science will overcome such headwinds and successfully develop a vaccine. Until then, the volatility experienced in the stock market will persist as investors grapple with the economic fallout of the pandemic-induced recession.

Recent Comments